You might need to open a new bank account when you move to a new city or find a bank with lower fees or better interest on a savings account. You may also switch direct deposit accounts simply to reorganize your finances or meet new budget priorities. If you’re paying high monthly fees, that’s a clear sign it’s time to switch bank accounts.

Whatever the reason, switching direct deposit accounts with your employer is usually a fairly simple process. If you’re wondering how to change direct deposit from one bank to another, you’ll find the steps to take below. You’ll also find additional things to consider when changing direct deposit at work.

Switching banks may seem like a hassle, especially if you have everything set up to run through your account. Whether it’s worth changing bank accounts or changing direct deposit accounts will depend on your situation. If you can save money or pick up extra perks along the way, switching direct deposit accounts might be worthwhile for you. Changing direct deposit at work usually takes just a few steps, making it worth it for many people — especially if the new account comes with better terms or a signup bonus.

It can be easy to switch direct deposit accounts. Even if you switch direct deposit accounts, you don’t have to close the old bank account, especially if it is a no-fee account. Here are the steps to follow:

Every company has its own rules when it comes to making changes to a direct deposit account. Usually, no matter the company, you’ll want to inform your employer or HR department that you plan to switch direct deposit accounts.

If you have an employee handbook, you may find the protocol for changing your bank account information inside. If not, check with your boss or HR department on how to switch direct deposit accounts. You might be asked to fill out a simple form or submit the request in an online database or the payment processing software your company uses.

If you’re retired, you’ll want to notify Social Security of your new bank account for direct deposits. You can do that online or over the phone 24 hours a day, seven days a week in English or Spanish.

As a part of submitting a new direct deposit form or submitting a request to your employer, you’ll need to supply your new bank account details. They may accept a direct deposit enrollment form prepared by your financial institution as long as it includes your banking information.

If they don’t accept the form, you can update your banking information online through your company’s payroll or benefits website.

A change to your direct deposit account might not be immediate. It’s possible that your direct deposit change will take effect before your next pay period, but that is not always the case. It is a good idea to ask your employer or the HR department when they will deposit your money into your new account.

Because direct deposit changes may take a while before they are processed, you may receive a paper check. If you want to ensure direct deposit in your new account, be sure to submit the new request immediately after the previous payment to give your employer more time for processing. Avoid changing direct deposit before payday if you don’t want to wait until next month for the new deposit.

It is helpful to keep your old account open during a direct deposit switch. Although owning multiple accounts at different banks might seem a bit overwhelming, you don’t want to close your old account until your money gets deposited into your new one. Once it does, you can close the old account.

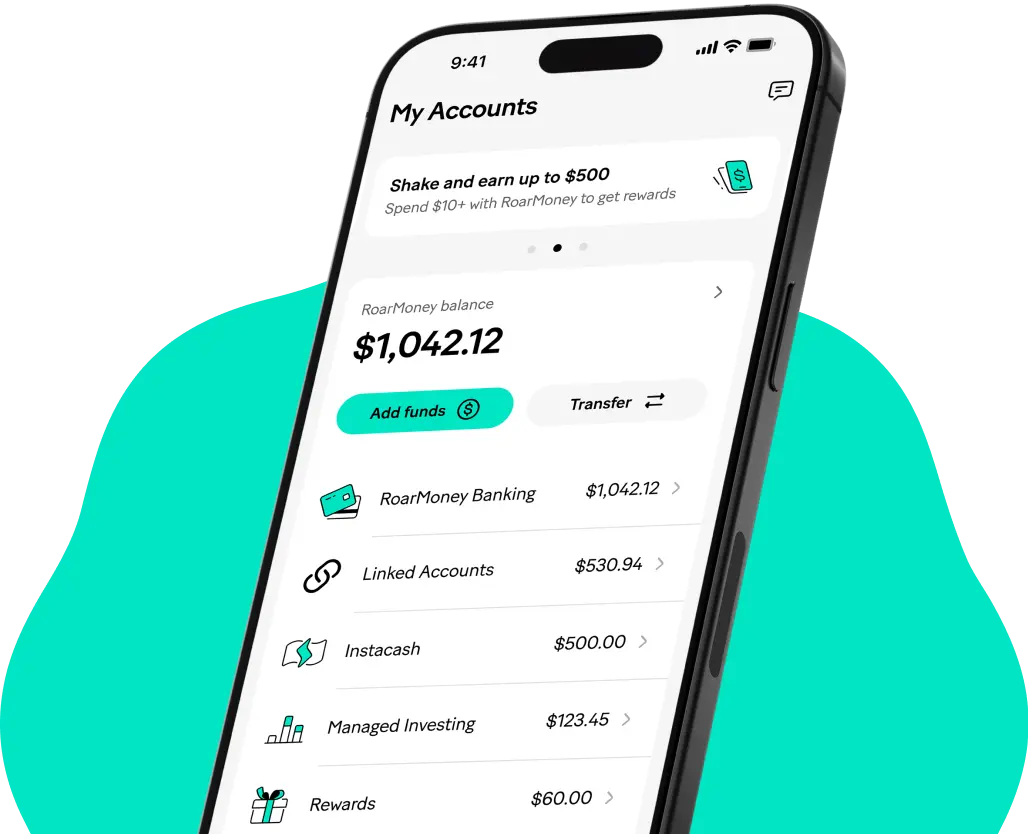

Having multiple accounts doesn’t have to stress you out. With online banking apps, you can keep a close watch over your bank accounts from your phone.

Having multiple bank accounts can make it easier to plan for goals and manage expenses. For example, one account can be used for normal household expenses, while other bank accounts are designated for specific goals, from an emergency fund and vacations to college savings.

In addition to switching direct deposit accounts, be sure to check whether you need to switch over direct debits. If you have automatic credit card payments, utility payments, or other regular direct debits, you’ll probably want to switch those over to the new account as well.

This is also true for subscription payments that are set up on direct debits, like a gym membership or streaming service. If you have any recurring transfers, like automatic transfers to investment accounts or retirement accounts, you may need to switch these after you change direct deposit accounts.

Switching direct deposit accounts has many benefits. If you choose to switch direct deposit accounts, you could get extra savings, better benefits, or greater ease in managing finances. An additional bank account may help you better plan for big financial goals like a special vacation or to save for a mortgage down payment. Be sure to choose bank accounts with low or no fees and favorable interest rates.

No, most of the time, switching bank accounts won’t affect your credit score. Opening a new bank account doesn’t usually trigger a hard inquiry on your credit.

When you switch banks, you’ll want to switch direct debits over to the new bank account. Otherwise, the direct deposits could be rejected and you could run into trouble with bill payments.

Yes, you can switch direct deposit accounts before payday. Keep in mind that if you change the direct deposit close to payday, the change might not be registered in the system. This could lead to a delayed payment or payment in the old bank account.

Written by Anna Yen Anna Yen, CFA, has nearly 2 decades of experience in financial markets, primarily with JPMorgan and UBS. Currently, she manages digital assets and her goal at FamilyFI is to empower families with financial literacy. She’s worked in 5 countries and visited 57.

Disclosures

This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own financial, legal, and tax advisors before engaging in any transaction. Information, including hypothetical projections of finances, may not take into account taxes, commissions, or other factors which may significantly affect potential outcomes. This material should not be considered an offer or recommendation to buy or sell a security. For more information about MoneyLion, please visit https://www.moneylion.com/terms-and-conditions/ .

This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own financial, legal, and tax advisors before engaging in any transaction. Information, including hypothetical projections of finances, may not take into account taxes, commissions, or other factors which may significantly affect potential outcomes. This material should not be considered an offer or recommendation to buy or sell a security. While information and sources are believed to be accurate, MoneyLion does not guarantee the accuracy or completeness of any information or source provided herein and is under no obligation to update this information. For more information about MoneyLion, please visit https://www.moneylion.com/terms-and-conditions/.

Open a RoarMoney account to bank with no minimums, no hidden fees, no BS! And you’ll love the perks like a contactless debit card, early payday, cashback, and fraud protection.

![]()

![]()

![]()

![]()

![]()

TikTok

![]()

![]()

![]()

![]()

![]()

YouTube

MoneyLion NMLS ID 1237506

© 2013 - 2024, MoneyLion Inc. All Rights Reserved.